rhode island tax rates 2021

3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of.

Rhode Island Estate Tax Everything You Need To Know Smartasset

If youre married filing taxes jointly theres a tax rate of 375 from 0 to 66200.

. 1 Rates support fiscal year 2021 for East Providence. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Find your gross income.

7 Rates rounded to two decimals 8 Denotes homestead exemption available or owner occupied tax rate. Get Your Max Refund Today. FY 2021 Rhode Island Tax Rates by Class of Property.

The bottom of the threshold is 154 million so we subtract that from 1662344 million and get 122344. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax. Ad Compare Your 2022 Tax Bracket vs.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island government. East Providence City Hall. East Providence RI 02914.

Find your pretax deductions including 401K flexible account contributions. Your 2021 Tax Bracket to See Whats Been Adjusted. In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately.

Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. Import Your Tax Forms And File For Your Max Refund Today.

40 rows Rhode Island Property Tax Rates. Exemptions to the Rhode Island sales tax will vary by state. BARRINGTON 2090 2090 2090 3500 BRISTOL 1407 1407 1407 1735 BURRILLVILLE 1601 1601 1601 3500 CENTRAL FALLS 8 2369 3795 6993 3500 CHARLESTOWN 2 823 823 823 1308 COVENTRY 2 7 1897 2287 1897 1875 CRANSTON.

This is an increase of 7500 101 from the 2021 taxable wage base of 74000. 2022 Tax Rate 11 percent 0011 The Temporary Disability Insurance contribution rate will be 11 percent for calendar year 2022. The combined rate used in this calculator 7 is the result of the rhode island state rate 7.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. 3 rows 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and.

Tax rates are provided by Avalara and updated monthly. Get A Jumpstart On Your Taxes. Any income over 150550 would be taxes at the highest rate of 599.

Look up 2021 sales tax rates for Centerdale Rhode Island and surrounding areas. RI-1040 RI-1040ES RI-1040H RI-1040MU RI-1040NR RI-1040NR. M-F 8AM - 4PM.

The TDI Taxable Wage Base for Rhode Island employees will be 81500 in 2022. The 2021 TDI Contribution Rate was 13 percent. Rhode Island Municipality Residential Real Estate Commercial Real Estate Personal Property.

3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three. Uniform tax rate schedule for tax year 2021 personal income tax Taxable income. Find your income exemptions.

Download 2021 tax forms for Rhode Island including. Tax Rate Income Range Taxes Due 375 0 to 66200 375 of Income 475 66200 to 150550 248250 475 599 150550. City of East Providence Rhode Island.

Over But not over Pay percent on excess of the amount over 0 66200 -- 375 0 66200 150550 248250 475 66200 150550 -- 648913 599 150550. For those earning more than. Tax rates have been rounded to two decimal places in Coventry and North Smithfield.

MUNICIPALITY NOTES RRE COMM PP MV. PPP loan forgiveness - forms FAQs guidance. Finally we add 8809 to the base taxes 70800 to get a total Rhode Island estate tax burden of 79609 on a 32 million estate.

3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three. 2 Municipality had a revaluation or statistical update effective 123120. Discover Helpful Information and Resources on Taxes From AARP.

2021 Tax Rates. That sum 122344 multiplied by the marginal rate of 72 is 8809. We last updated Rhode Island Form HCP-65 in March 2022 from the Rhode Island Division of Taxation.

Top States To Buy Real Estate In The New Decade Financial Samurai Real Estate Buying Real Estate Real Estate Prices

Estate Tax Ri Division Of Taxation

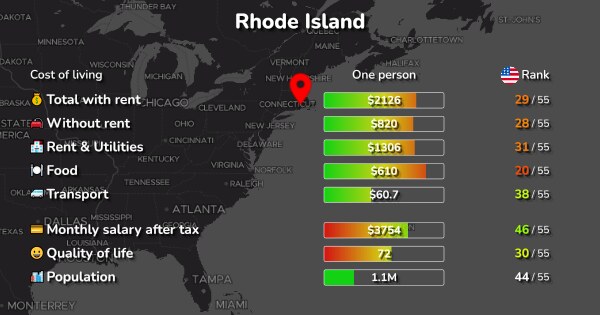

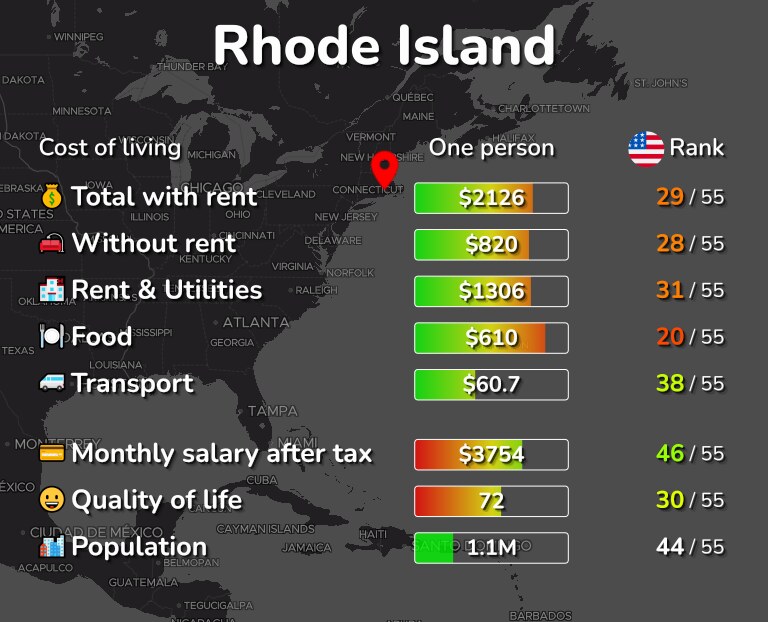

Cost Of Living Prices In Rhode Island 18 Cities Compared

Free Printable And Fillable 2019 Rhode Island Form Ri 1040 And 2019 Rhode Island Form Ri 1040 Instructions Booklet In Tax Forms Income Tax Return Tissue Types

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Brackets 2020

Cost Of Living Prices In Rhode Island 18 Cities Compared

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

Rhode Island Aca Reporting Deadline Rhode Island Island Health Plan

Rhode Island Income Tax Calculator Smartasset

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Rhode Island Retirement Taxes And Economic Factors To Consider

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Sales Tax Small Business Guide Truic